Silicon Valley Bank – 16th largest in the US – is the latest casualty of the Fed assault on inflation[1]. It was regulated as a regional bank, and these are typically local, specialising in one sector (e.g. agriculture). SVB also specialised in one sector – tech – but it had a global reach. With assets of less than $250bn, they benefited from looser regulation and built a loan portfolio of start ups with limited assets, patchy cash flows, and no profits. Customers included Biotech, Fintech, Crypto and even California wineries.

COVID and war put many venture capital projects on hold, so SVB had excess deposits which it invested in medium maturity US Treasuries. If the Fed pivoted and interest rates dropped, SVB would profit; but rates rose – the classic banking trap of borrowing short and lending long. In the same week that SVB were shut down, two crypto banks closed – Silvergate (voluntary) and Signature (FDIC), both due to bank runs and similar duration mismatches in Treasuries.

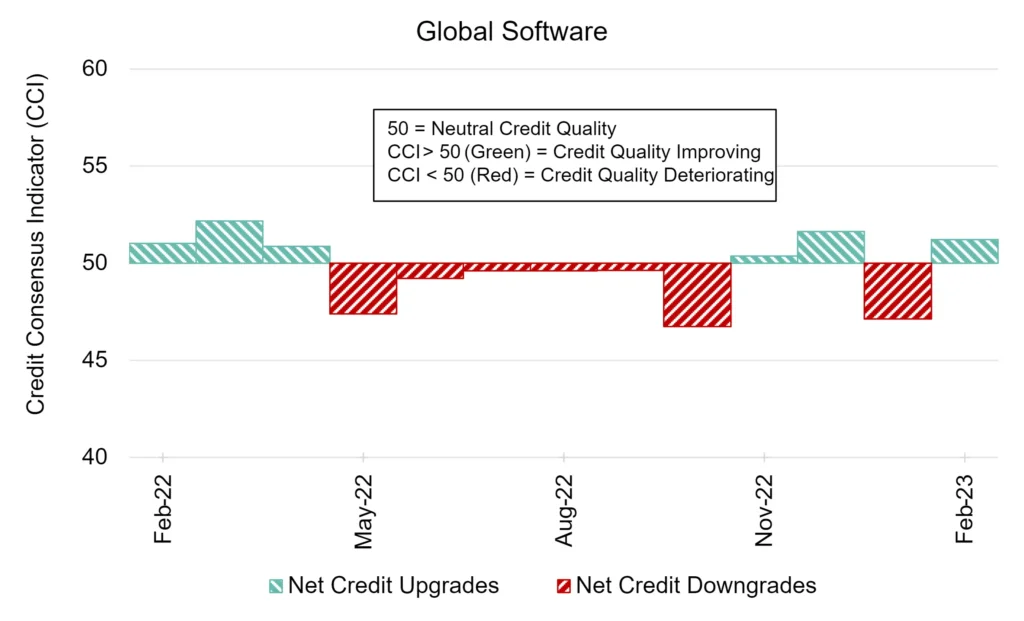

SVB’s loan book was also squeezed by a tech recession that has brought layoffs to Amazon, Meta, Twitter etc. The Credit Benchmark Global Software Index shows a bias to downgrades for 7 of the last 10 months.

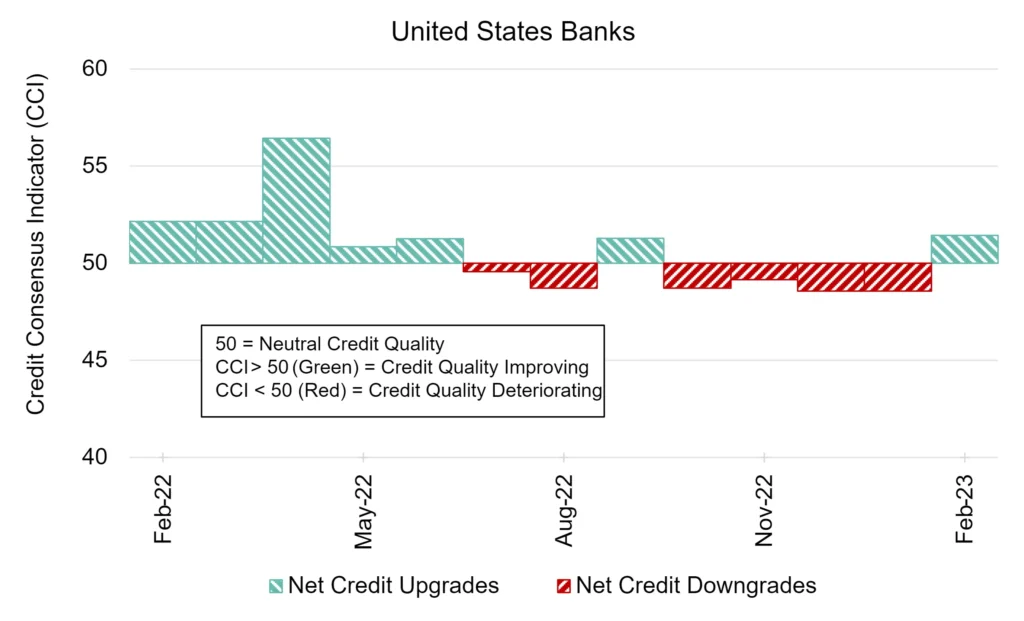

Bank credit warning signs have been flashing in consensus credit data for the past few months. The Credit Benchmark US Banks index shifted towards downgrades 8 months ago and has been negative in 6 of those. (Moody’s have now also downgraded the entire US banking sector.)

This move started ahead of a similar emerging trend in the Credit Benchmark Global Banking Index; the downgrade trend has even reached the Credit Benchmark GSIB index, which has started to register net downgrades for 3 of the past 6 months.

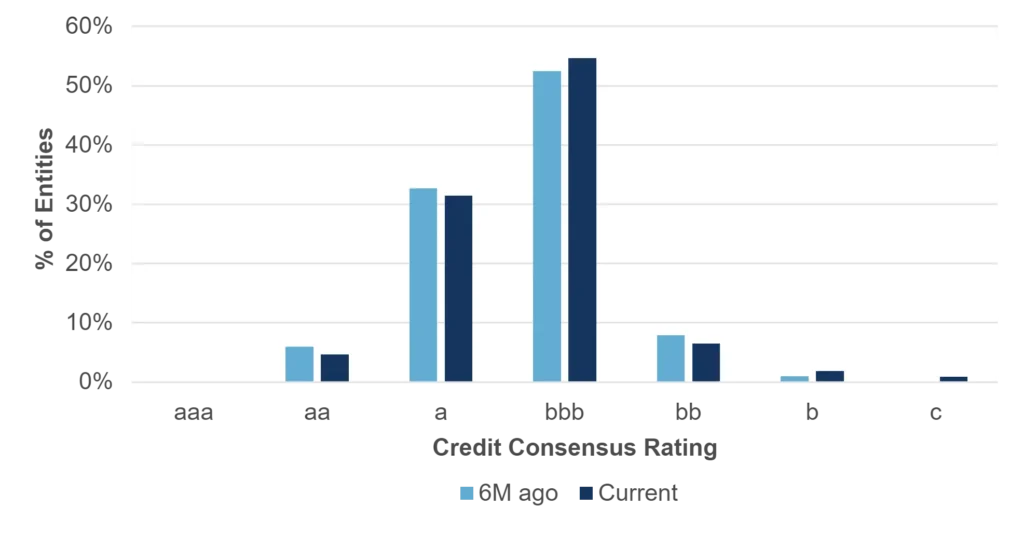

The Credit Benchmark US Regional Banks index (119 constituents) below also shows the credit distribution shifting to the right, (i.e. cumulative downgrades) in the past 6 months:

Regional bank solvency is likely to suffer from a flight to quality as depositors abandon smaller, less regulated, less well capitalised banks – relatively good for GSIBs. SVB may also be the tip of a larger bank risk iceberg – as rates rise and liquidity tightens, defaults will climb; even the largest banks need to reserve against those, and they need to raise capital more widely. At the very least, this means cash calls and rights issues – negative for share prices.

We expect to see further bank downgrades globally, tighter regulation, capital raising through bond and equity issues, shrinking loan books, higher defaults, bank mergers, and possible sporadic state intervention in weaker banks – which may hit some Sovereign ratings.

Credit Benchmark data is updated every two weeks. End-February data flash update is now available.

Enjoyed this report? If you’d like to see more consensus-based credit ratings, mid-point probabilities of default and detailed analytics on 75,000 public and private global entities, please complete your details to request a demo or coverage check:

[1] Traditionally, rising short rates bring lower long rates – bond markets are happy to see central banks bearing down on inflation, so they will accept lower bond yields and pay higher bond prices because they see the inflation spike as temporary. But the latest hikes come at the end of a very long period of QE – since 2008, central banks have been buying bonds to keep rates low. They ended up owning so much of the global Government bond market that this policy had run out of road – so QE (Quantitative Easing) has been switched to QT (Quantitative Tapering).